Dalam perdagangan, kita boleh bergantung pada sekumpulan isyarat kemasukan yang berbeza.

2023-01-26 • Dikemaskini

Stablecoins adalah kelas baru matawang kripto yang cuba menawarkan kestabilan harga dan disokong oleh aset rizab. Stablecoins telah mendapat momentum di atas usaha mereka untuk menawarkan ciri yang terbaik dari kedua-dua dunia – pemprosesan yang segera, keselamatan atau privasi pembayaran matawang kripto, dan penilaian mata wang fiat (USD konvensional) yang stabil tanpa kemeruapan. Seperti semua matawang kripto, stablecoin dibina berasaskan teknologi blockchain – pangkalan data terpencar yang menyimpan maklumat dengan cara yang tertentu. Blockchain membolehkan kita untuk tidak lagi bergantung pada satu pusat data tunggal kerana setiap transaksi dan lejar itu sendiri disimpan di setiap nod (titik persimpangan) rangkaian.

Walaupun bitcoin tetap menjadi matawang kripto paling popular, ia cenderung terkesan dari kemeruapan yang tinggi dalam penilaiannya. Sebagai contoh, ia meningkat dari $30,000 menjadi $58,000 di antara 27 Januari dan 21 Februari 2021, dan turun dari $64,650 menjadi $29,100 antara 14 April dan 19 Mei 2021. Bukan mudah untuk membuat pembayaran dengan instrumen yang semeruap ini. Sebagai gantinya, stablecoin menawarkan penyelesaian yang kurang meruap. Dilindungi oleh aset nyata sebagai sandaran, ia mengingatkan kita kepada matawang fiat, yang ditambat dengan aset pendasar seperti rizab forex.

Walaupun dalam keadaan melampau yang tertentu bila mana penilaian matawang fiat bergerak secara drastik, pihak berkuasa yang bertanggungjawab masuk campur dan menguruskan permintaan dan penawaran matawang untuk mengekalkan kestabilan harga. Stablecoins ada di sini untuk membantu semua pengguna matawang kripto mencari kestabilan di waktu yang meruap.

1. Stablecoins Yang Disokong Dengan Komoditi

Stablecoins yang ditambat dengan komoditi umumnya disokong dengan aset ketara untuk kestabilan. Aset ketara tersebut boleh berbentuk harta tanah atau emas. Walau bagaimanapun, aset ketara yang paling banyak digunakan untuk sandaran adalah emas, di mana banyak stablecoins menggunakan pelbagai koleksi logam berharga. Beberapa contoh token tersebut ialah Tether Gold dan Palladium Coin.

2. Stablecoins Yang Disokong Dengan Aset Crypto

Stablecoins yang bersandaran kripto disokong dengan matawang kripto lain. Oleh kerana matawang kripto rizab juga boleh terdedah kepada kemeruapan yang tinggi, stablecoin seperti itu "dikolateralkan secara berlebihan" (over-collateralized), di mana sebilangan besar token matawang kripto dikekalkan sebagai rizab untuk mengeluarkan bilangan stablecoin yang lebih rendah. Contohnya, Ether yang bernilai $2,000 boleh disimpan sebagai rizab untuk mengeluarkan stablecoins bersandarkan kripto bernilai $1,000 yang boleh menampung sehingga 50% swing pada matawang rizab (Ether).

3. Stablecoins Yang Disokong Dengan Matawang Fiat

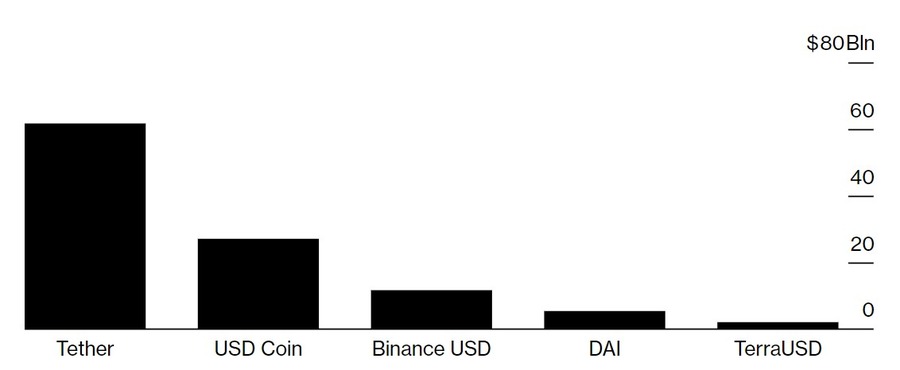

Stabilcoin yang dijamin dengan fiat menyenggara sejumlah rizab matawang fiat, seperti dolar A.S., sebagai kolateral untuk mengeluarkan sejumlah syiling crypto. Ia sangat popular, terutamanya kerana ia dianggap sebagai mesin cetak ekonomi matawang kripto dan kerana ia memberikan kestabilan di pasaran yang sentiasa berubah-ubah. Untuk mematuhi syarat kawalan selia yang ketat, ia perlu menjalani prosedur pengauditan. Matawang kripto yang bersandaran fiat yang paling popular di dunia adalah Tether (USDT), USD Coin (USDC), dan Binance USD (BUSD), dengan jumlah permodalan lebih dari $100 bilion.

4. Stablecoins Algoritma (Seigniorage).

Stablecoin algoritma menggunakan algoritma untuk meningkatkan atau mengurangkan rizab matawang digital secara automatik seperti yang dilakukan oleh pengurus bekalan wang di dunia sebenar. Sebilangan besarnya hilang kerana peraturan.

5. Matawang digital bank pusat (CBDC).

CBDC adalah mata wang digital yang disokong oleh bank pusat kerajaan. Ia adalah suatu bentuk matawang yang disokong oleh negara, seperti wang kertas. Ia disokong oleh negara, bukan syarikat, atau, dalam kes Bitcoin, blockchain. Oleh kerana ia terikat dengan matawang negara berkenaan, CBDC akan berubah-ubah seiring dengan matawang tradisional. Sebilangan besar model CBDC dikawal sepenuhnya di bawah pihak berkuasa pusat. China adalah negara pertama yang membuat pelancaran ujian Yuan China sebagai CBDC pada Februari 2021. Dalam komuniti kripto, ia tidak digemari justeru kerana sentralisasi yang 100% dan ketiadaan ciri ketanpanamaan.

Tether atau USDT adalah stablecoin yang terbesar dan paling popular dengan permodalan pasaran keseluruhan lebih dari $62 bilion!

Sumber: https://www.bloomberg.com/news/articles/2021-07-26/tether-executives-said-to-face-criminal-probe-into-bank-fraud?sref=qgDWnyMx

Tether dirancang khusus untuk menjadi jambatan yang diperlukan untuk menghubungkana matawang fiat dan matawang kripto, dan menawarkan kestabilan, ketelusan, serta caj transaksi yang minimum kepada pengguna. Ia ditambat kepada dolar A.S. dan mengekalkan nisbah 1:1 dengan dolar A.S. dari segi nilai.

Melihat dari perspektif lain pula, Tether mempunyai kekurangan. Tether telah dituduh kekurangan ketelusan dan ada kejanggalan dengan rizab sandarannya. SEC AS menuntut Tether, mengatakan bahawa syarikat itu tidak mempunyai cukup USD untuk mengkoleteralkan setiap USDT yang dikeluarkan. Walau bagaimanapun, firma perakaunan Moore Cayman telah mengesahkan laporan "aset dan liabiliti" dari Tether pada bulan Februari. Pada 28 Februari 2021, Tether memiliki lebih dari 100% aset untuk menyokong penerbitan stablecoin yang bersandarkan fiat dan komoditi. AS tidak berhenti setakat di situ dan setelah enam bulan Jabatan Kehakiman meminta pengesahan rizab. Pada 9 Ogos 2021, Tether mengeluarkan satu lagi laporan jaminan, sekali lagi mengesahkan bahawa rizab mereka bersandaran sepenuhnya.

Dengan FBS anda boleh dagangkan matawang kripto secara berpasangan dengan USDT. Ia boleh diandalkan, pantas, dan popular. Jangan lepaskan peluang untuk melihat pergerakan matawang kripto yang meruap-ruap dengan FBS!

Mungkin risiko stablecoin yang terbesar adalah pemusatan. Stablecoins mesti dijamin dengan beberapa aset, anda tidak boleh melombongnya seperti Bitcoin atau memperolehinya sebagai ganjaran kerana giat menjadi ahli rangkaian yang aktif. Justeru, walaupun ini masih matawang kripto, dan semua transaksi dapat dilihat oleh semua orang, tidak dapat diundur semula dan selamat, penerbitan token baru berlaku di tangan beberapa orang. Ada beberapa pihak telah menuduh penerbit stablecoin mengepam pasaran matawang kripto dengan percetakan token secara berterusan.

Matawang kripto adalah industri kewangan yang masih muda dan bercita-cita tinggi dengan pertumbuhan yang pesat dan peluang baru sentiasa muncul. Pastikan anda tidak ketinggalan keretapi!

Nantikan lebih banyak artikel mengenai industri matawang kripto, dan berdaganglah dengan FBS!

Tidak tahu bagaimana cara untuk memperdagangkan matawang kripto? Ikuti langkah-langkah mudah berikut.

Dalam perdagangan, kita boleh bergantung pada sekumpulan isyarat kemasukan yang berbeza.

Pola carta segitiga (triangle chart patterns) ialah pola pengukuhan yang melibatkan harga aset yang bergerak dalam julat yang semakin mengecil.

Perdagangan mempunyai beberapa tahap kerumitan, bermula daripada yang paling mudah, seperti membeli dan menjual aset rawak, sehinggalah kepada yang lebih komprehensif, dengan pengurusan risiko, masa, dan objektif yang disengajakan.

Klik butang 'Buka akaun' di laman web kami dan teruskan ke Laman Peribadi. Sebelum anda boleh mula berdagang, lengkapkan dahulu proses pengesahan profil anda. Sahkan alamat emel dan nombor telefon anda, sahkan ID anda. Prosedur ini menjamin keselamatan dana dan identiti anda. Sebaik anda selesai dengan semua prosedur keselamatan ini, pergi ke platform perdagangan yang menjadi pilihan anda, dan mulakan berdagang.

Jika anda berumur 18+, anda boleh sertai FBS dan mulakan kembara FX anda. Untuk berdagang, anda perlukan sebuah akaun perbrokeran dan ilmu yang mencukupi tentang tindak-tanduk aset di pasaran kewangan. Mulakan dengan mempelajari ilmu-ilmu asas menerusi bahan-bahan pengajian percuma kami dan buka akaun di FBS. Mungkin anda mahu mencuba suasana perdagangan dengan wang maya di akaun Demo terlebih dahulu. Apabila anda sudah bersedia, masuk ke pasaran sebenar dan berdagang untuk berjaya.

Prosedurnya jelas dan mudah. Pergi ke laman Pengeluaran di laman web, atau bahagian Kewangan di Laman Peribadi FBS dan akses Pengeluaran. Anda boleh dapatkan wang yang anda raih menerusi sistem pembayaran yang sama yang anda gunakan untuk deposit-deposit anda. Sekiranya anda mendanai akaun anda menerusi pelbagai kaedah, keluarkan keuntungan anda menerusi kaedah-kaedah yang sama, berkadaran dengan nisbah amaun deposit-deposit anda.

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!